|

Go to Bitcoin Price History Timeline

Click here for the Bitcoin page in Wikipedia

Click here for "Quebec pulls the plug" Dec 2022 in WSJ

Click here for Bitcoin Maintainers Feb 2023 in WSJ i.e. keeping Bitcoin software "bug-free"

Click here for current prices on Bitcoin and other cryptocurrencies.

Includes Ethereum co-founded by Vitalik Buterin (wikipedia).

Click here for the number of transactions added to the "mempool" each second during the past year.

BITCOIN Notes (www.swcs.com.au/bc.asp)

http://satoshi.nakamotoinstitute.org (click for an Intro).

Click here for a current total of bitcoins on issue.

Click here for its current $AU price.

Click here for a current blocks status.

Click here for a current total transaction count.

Click here for a current total unspent transaction count.

Click here for a current size of the blockchain in gigabytes.

Click here for a current total of reachable nodes.

Click here for some notes on its mining difficulty.

It is adjusted every 2016 blocks based on the time it took to find them. At the desired rate of one block each 10 minutes, 2016 blocks would take exactly two weeks to find. If the previous 2016 blocks took more than two weeks to find, the difficulty is reduced. If they took less than two weeks, the difficulty is increased.

Click here for a graph (plus latest change) of the difficulty level since its inception in 2009.

Current Bitcoin transaction speed: 5.08 transactions per second based on its past year as at 15 Feb 2024.

Earlier Bitcoin transaction speed: 3.58 transactions per second based on a previous year as at 15 Feb 2021.

Even Earlier Bitcoin transaction speed: 3¼ transactions per second based on an even earlier year as at 15 Dec 2017.

With a Shorter block time: PRO - Faster 1 confirmation time (to protect from 0-confirm double spend) PRO - Less payout variance for miners (less reliance on large pools) CON - Requires increased bandwidth (inter node communication) CON - More forks, longer forks, and longer re-org time CON - A greater portion of the raw hashpower is wasted, resulting in lower effective security. With a longer block interval target of longer than 10 minutes, the pros and cons would be reversed

Two examples of Cryptocurrencies with shorter block creation intervals are

It currently offers 3 ether to its miners with a new block created every 15 seconds. Includes many empty blocks when there is no activity. Because of that very short interval between blocks, it can take a long time to "get back to sync" if a node is switched off.

A third example of a cryptocurrency, Bitcoin Cash, was launched Aug 2017 as another fork in the Bitcoin database. It retained the ten minute interval, but extended the block size to about eight megabytes. Passed Ethereum in popularity in Nov 2017.

Back to Bitcoin.

Click here for some stats on empty blocks (about 1%) and small blocks less than 10 transactions (about 1%)

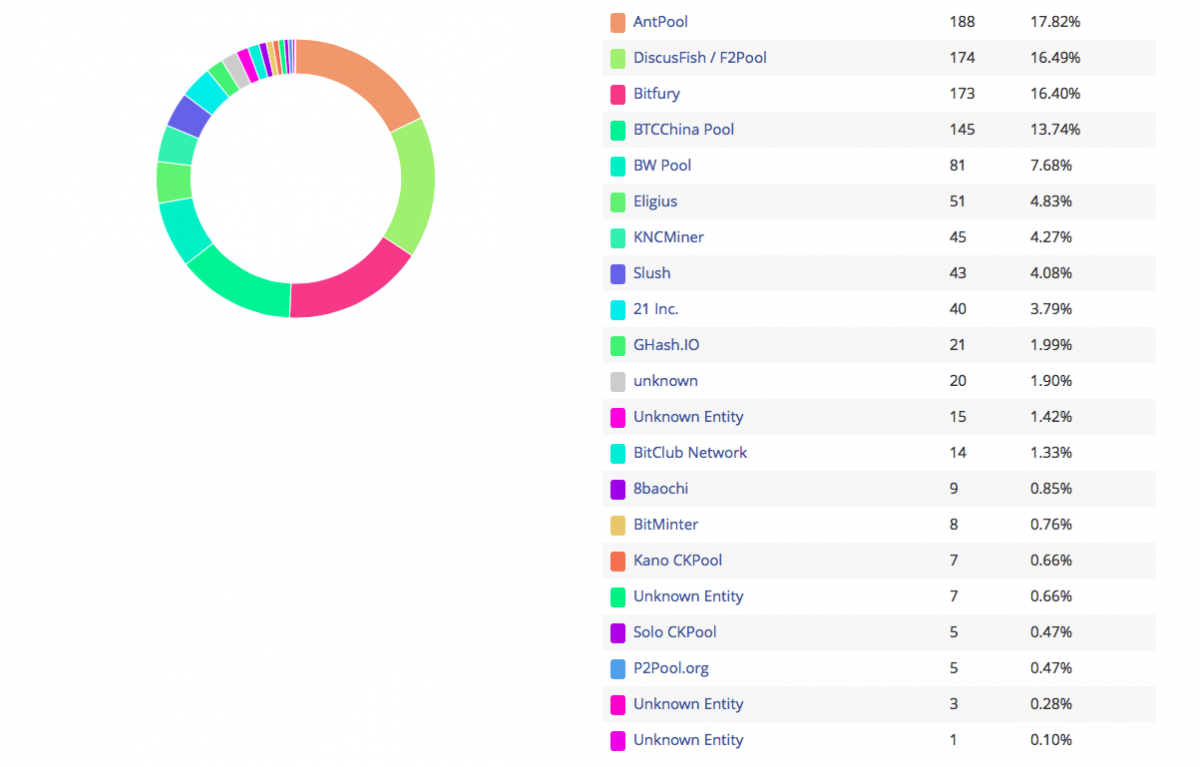

DANNY FORTSON The Times 11:00AM December 10, 2017 When Nakamoto launched the system with the creation of the first block, the reward was 50 bitcoin. Every four years, that halves and the puzzles get harder. What could be done on a laptop now requires vast computer farms drawing cheap hydro-electric power in Mongolia. Chainalysis, which tracks bitcoin activity, has estimated that up to 3.7m bitcoin — dollars 61bn worth — is lost for ever. Most of the unrecoverable loot can be traced back to the early days when it was easy to mine and each bitcoin was worth just a few cents. The next “halvening”, as it is known, will take place in 2020. Coinbase, an online exchange that allows bitcoin trading, became the most downloaded app in the Apple Store last week. Last week, NiceHash, a bitcoin mining firm based in Slovenia, admitted hackers had made away with 4,700 bitcoin, a haul worth dollars 76m as of Friday’s price. The most famous case occurred in 2014, when exchange Mt Gox collapsed after cyber criminals stole about 850,000 bitcoins, worth nearly dollars 14bn today. When selling bitcoins, you have to offer a high enough transaction fee, thus "outbidding others" to get it transferred quickly from a node's "mempool" to a block. Note that in bitcoin there is no global mempool, every node keeps its own set of unconfirmed transactions that it has seen. Nodes store these mempools for miners to access and can set a minimum fee if they have limited storage. Transactions can thus remain unconfirmed for hours or even days. Eventually they will be cancelled. Opt-in Replace-by-fee In most cases, when the same transaction is re-sent over the network, but with a higher fee, the new transaction is rejected by the network. Bitcoin nodes typically consider this new transaction a double spend, and will therefore not accept or relay it. But when sending a transaction using Opt-In RBF, you essentially tell the network you may re-send that same transaction later on, but with a higher fee. As a result, most Bitcoin nodes will accept the new transaction in favor of the older one; allowing the new transaction to jump the queue. Whether your new transaction will be included in the very next block does depend on which miner mines that next block: not all miners support Opt-In RBF. However, enough miners support the option to, in all likelihood, have your transaction included in one of the next couple blocks. Opt-In RBF is currently supported by two wallets: Electrum and GreenAddress. Depending on the wallet, you may need to enable Opt-In RBF in the settings menu before you send the (first) transaction. Child Pays for Parent (CPFP) CPFP may do the trick. Applying CPFP, miners don't necessarily pick the transactions that include the most fees, but instead pick a set of transactions that include most combined fees. Without getting into too many technical details, most outgoing transactions do not only send bitcoins to the receiver, but they also send "change" back to you. You can spend this change in a next transaction. Some wallets let you spend this change even while it is still unconfirmed, so you can send this change to yourself in a new transaction. This time, make sure to include a high enough fee to compensate for the original low fee transaction. A miner should pick up the whole set of transactions and confirm them all at once. Since completion of this article, mining pool ViaBTC started offering a "transaction accelerator". If your transaction is stuck and includes at least 0.1 mBTC fee per kilobyte, you can submit the transaction-ID to ViaBTC, and the pool will prioritize it over other transactions. Since ViaBTC controls about seven percent of hash-power on the Bitcoin network, there is a good chance it will find a block within a couple of hours. The service is limited to 100 transactions per hour, however. As the Receiver Of course, a transaction can also get stuck if you’re on the receiving end of it. If your wallet allows spending unconfirmed transactions, this can be solved with CPFP as well. Much like as mentioned before, you can re-spend the unconfirmed, incoming bitcoins to yourself, including a fee high enough to compensate for the initial low fee transaction. If the new fee is sufficient, the transaction should typically confirm within a couple of blocks. The only other option is to ask the sender whether he used Opt-In RBF. If so, he can re-send the transaction with a higher fee. Update: Of course, ViaBTC’s transaction accelerator (mentioned above) works for incoming transactions as well. Five mining pools have been winning about 70% of all commissions. Here are some lists.

https://www.blocktrail.com/BTC

Here are links to some articles on Bitmain, which in 2017 was probably the largest miner in the world.

https://en.wikipedia.org /wiki /Bitmain

https://www.nytimes.com /2017/09/13/ business/bitcoin-mine-china.html

https://qz.com /1056236 /take-a-walk-around-one-of-the-worlds-biggest-bitcoin-mines/ Aug 17 2017

https://qz.com /1055126 /photos-china-has-one-of-worlds-largest-bitcoin-mines Aug 17 2017

And here are the other major mining pools.

Meet the 21 companies you've never heard of (in 2015) that are battling to control bitcoin ROB PRICE AUG 13, 2015, 7:43 PM

https:// www.buybitcoinworldwide.com /mining /pools/ Jul 13 2017

What is a Mining Pool? Mining pools are groups of cooperating miners who agree to share block rewards in proportion to their contributed mining hash power. While mining pools are desirable to the average miner as they smooth out rewards and make them more predictable, they unfortunately concentrate power to the mining pool’s owner. Miners can, however, choose to redirect their hashing power to a different mining pool at anytime. Pool Concentration in China Before we get into the best mining pools to join, it’s important to note that most mining pools are in China. Many only have Chinese websites and support. Mining centralization in China is one of Bitcoin’s biggest issues at the moment. There are about 20 major mining pools. Broken down by the percent of hash power controlled by a pool, and the location of that pool’s company, we estimate that Chinese pools control ~81% of the network hash rate: China - 81% Iceland - 5% Japan - 3% Czech Republic - 3% Georgia - 2% India - 2% 1. Antpool Antpool is a mining pool based in China and owned by BitMain. Antpool mines about 25% of all blocks. 2. BTC.top BTC.top is a private pool and cannot be joined. China 11% 3. BTC.com BTC.com is a public mining pool that can be joined. However, we strongly recommend joining Slush Pool instead. China 10% 4. Bixin Bixin is another mining pool that is based in China. It is a public pool, but unless you speak Chinese we do not recommend joining this pool. 8% 5. BTCC BTCC is a pool and also China’s third largest Bitcoin exchange. Its mining pool currently mines about 7% of all blocks. 6. F2pool DiscusFish, also known as F2Pool, is based in China. F2Pool has mined about 5-6% of all blocks over the past six months. 7. ViaBTC ViaBTC is a somewhat new mining pool that has been around for about one year. It’s targeted towards Chinese miners. 8. BW Pool BW, established in 2014, is another mining company based in China. It currently mines about 5% of all blocks. 9. Bitclub.Network Bitclub Network is a large mining pool but appears to be somewhat shady. We recommend staying away from this pool. 10. Slush Slush was the first mining pool and currently mines about 3% of all blocks. Slush is probably one of the best and most popular mining pools despite not being one of the largest. Get a Bitcoin Wallet and Mining Software Before you join a mining pool you will also need Bitcoin mining software and a Bitcoin wallet. Mining Pools vs Cloud Mining Many people read about mining pools and think it is just a group that pays out free bitcoins. This is not true! Mining pools are for people who have mining hardware to split profits. Many people get mining pools confused with cloud mining. Cloud mining is where you pay a service provider to miner for you and you get the rewards.

How does the bitcoin client make the initial connection to the bitcoin network? The Bitcoin client has a number of sources that it uses to locate the network on initial startup. In order of importance: 1) The primary mechanism, if the client has ever run on this machine before and its database is intact, is to look at its database. It tracks every node it has seen on the network, how long ago it last saw it, and its IP address. 2) The client can use DNS to locate a list of nodes connected to the network. One such seed is bitseed.xf2.org. The client will resolve this and get a list of Bitcoin nodes. 3) The client has a list of semi-permanent nodes compiled into it. What does Message sending look like:

https://en.bitcoin.it/wiki/Network

What is Block Height: The height of a block is the number of blocks in the chain between it and the genesis block. (So the genesis block has height 0.) The height of the block chain is usually taken to be the height of the highest block, in the chain with greatest total difficulty; i.e. the length of the chain minus one. For Example

| Height | Age | Transactions | Total Sent | Relayed By | Size (kB) | Weight (kWU) |

|---|---|---|---|---|---|---|

| 498533 | 11 minutes | 2324 | 14,614.42 BTC | Unknown | 1,068.36 | 3,992.15 |

| 498532 | 21 minutes | 1525 | 771.11 BTC | SlushPool | 1,029.19 | 3,992.86 |

| 498531 | 21 minutes | 2120 | 15,734.90 BTC | SlushPool | 1,055.31 | 3,992.54 |

| 498530 | 31 minutes | 1613 | 15,908.53 BTC | GBMiners | 1,063.9 | 3,992.83 |

Bitcoin Price Timeline

https://99bitcoins.com /price-chart-history/

Mt Gox Wiki

Mt Gox, in Tokyo Japan, opened in Jul 2010 as the first Bitcoin Currency Exchange. Others followed in Feb 2011. Still, in 2013, Mt Gox handled about 70% of all Bitcoin currency exchange trading. In February 2014, Mt Gox suspended trading, closed its website and exchange service, and filed for bankruptcy protection from creditors. In April 2014, the company began liquidation proceedings. Mt Gox announced that approximately 850,000 bitcoins belonging to customers and the company were missing and likely stolen, an amount valued at more than $450 million at the time. Although 200,000 bitcoins have since been "found", the reason(s) for the disappearance – theft, fraud, mismanagement, or a combination of these – were initially unclear. New evidence presented in April 2015 by Tokyo security company WizSec led them to conclude that "most or all of the missing bitcoins were stolen straight out of the Mt Gox hot wallet over time, beginning in late 2011. Starting in 2016, the bitcoin price recovered, though it dived in 2018. In January 2021, Elon Musk purchased $1½ billion worth of Bitcoin, without disclosing when or at what price the company bought bitcoin for. In February 2022, the Department of Justice announced it seized more than $3.6 billion in allegedly stolen bitcoin linked to the 2016 hack of Bitfinex. As part of the operation, authorities detained a New York couple on allegations they planned to launder the digital goods. In July 2022, Tesla announced it sold 75% of its Bitcoin, worth approximately $936 million. On November 11 2022, following a critical liquidity crisis, the world second largest cryptocurrency exchange, FTX has filed for bankruptcy, with co-founder Sam Bankman-Fried stepping down from his role as CEO.

| 18 Jul 2010 | $0.07 Mt Gox exchange opens trading |

| 9 Feb 2011 | $1.00 More exchanges featuring more currencies |

| 1 Jun 2011 | $9.20 |

| 1 Feb 2013 | $20.70 |

| 11 Mar 2013 | $47.40 |

| 17 Aug 2013 | $107.16 |

| 15 Nov 2013 | $431.69 |

| 25 Nov 2014 | $383.48 |

| 26 Nov 2015 | $343.62 |

| $534.79 | |

| 4 Nov 2016 | $700.40 |

| 12 Jan 2017 | $784.75 |

| 30 Mar 2017 | $1044.25 |

| 15 Jul 2017 | $2075.30 |

| 1 Aug 2017 | $2787.85 |

| 27 Sep 2017 | $3922.21 |

| 12 Oct 2017 | $4808.42 |

| 17 Nov 2017 | $7486.37 |

| 1 Dec 2017 | $10048.88 |

| 8 Dec 2017 | $15455.75 |

| 31 Jan 2018 | $10786.31 |

| 15 Nov 2018 | $6130.99 |

| 29 Dec 2018 | $3753.83 |

| 23 Dec 2019 | $7324.49 |

| 12 Feb 2020 | $10347.95 |

| 12 Mar 2020 | $4914.09 |

| 7 May 2020 | $9375.95 |

| 5 Nov 2020 | $15579.85 |

| 16 Dec 2020 | $21310.60 |

| 9 Jan 2021 | $40254.55 |

| 21 Feb 2021 | $57539.94 |

| 8 Nov 2021 | $67566.83 |

| 3 Dec 2021 | $53598.25 |

| 10 Dec 2021 | $47243.31 |

| 21 Mar 2022 | $41078.00 |

| 9 May 2022 | $30297.00 |

| 13 Jun 2022 | $22487.39 |

| 11 Nov 2022 | $17034.29 |

| 18 Apr 2023 | $30379.70 |

| 18 Oct 2023 | $28328.34 |

| 12 Dec 2023 | $41450.22 |

| 18 Feb 2024 | $52122.55 |

| 13 Mar 2024 | $73083.50 |

** End of Page